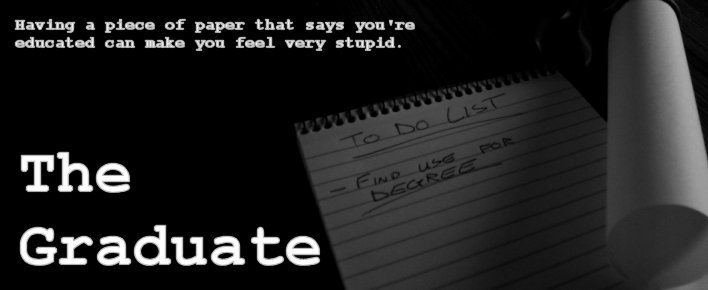

Due to a mixture of a rarefied existence at university and a natural lack of life experience, I often find myself assuming that everyone is trustworthy and deep down a generally good person. I often find myself saying “oh, but they’re ok really” and I’ve recently started to wonder if that’s always going to be the case.

This sentiment is often called naivety, but it made me think that maybe it’s not such a bad thing. It could be that the basic levels of trust are what gets us through society as a whole and maybe this naivety is just a good intention to get through life as smoothly as possible. I’m confident in the fact that even people that you couldn’t possibly describe as naive get caught out by people betraying them or otherwise acting in an untrustworthy manner, so maybe on some level we just need to forget about it, get past it and just hope we don’t get stung.

The following quote is from KPMG’s profile of a Fraudster published in 2007:

“Why are people often caught unaware when somebody is accused of fraud? Because it

is usually the colleague who is known to be helpful, polite and inconspicuous.

But most importantly it is the colleague that enjoys the absolute trust of both

superiors and colleagues.”

This is quite a frightening summary, and if we are to believe it, it means we need to become entirely self reliant in all matters and probably go and live in a cave, fending for ourselves for fear that the mild mannered guy who does all the printing might be the one stealing your sandwiches. Let the quote sink in for a while and you realise that what it is telling you is that those most likely to betray you are those that inspire the most trust in you.

It’s clear that everyone gets caught out. The number of frauds that take place on a daily basis are staggering and we’ll probably be seeing a lot more of them coming to light as we hit the recession, as the majority of frauds always come to light when money is a little bit more scarce. I’m guessing that this is because people start looking at their account books a little closer only to notice a few holes, and the most famous recent holes in account books started to become apparent around 20 years ago on the last market slump, such as the Robert Maxwell pension scandal, and we’ve already had some crackers in the financial crisis leading to our current recession, such as Bernard Madoff, whose fraud can no longer be called a fraud, but more of a lifetime achievement.

Despite massive frauds taking place on a daily basis, trust isn’t a bad thing. It is required for a smooth running of society after all. You have to trust the postman to deliver your letters, the bank manager to direct your finances without skimming bits off the top, the insurance company not to steal your credit card details when you give it to them over the phone, your contractors not to swipe your beer from the fridge, and your government not to give away your personal details, including the names, addresses and private phobias of your children. Whether or not you can trust them is irrelevant, you have to trust them on some level, other wise it all falls apart and you have to move in to that aforementioned cave.

I’m not saying that we should all live with our heads in the sand. It is clear in some situations that you shouldn’t hand money over for something. I’m not saying that you should respond to all those “update your information” requests that get emailed to you from “Loylds” or “Bralcays” or “Hallifacts” bank, or that you should give money to the Nigerian colonel in order to unfreeze his assets, but at the same time, try to have a little faith in the rest of humanity. I hate to go on about it, but my adventure with the washing machine generated a lot of distrust towards the man I was buying it from and in all sensibility I should have walked away, but as a result of having a little faith, I do now have a functioning washing machine and clean underwear again.

With the quote above in mind, look twice at the mild mannered man in grey who never offends but that just seems like a cog in the machine, but remember that not everyone is a fraudster and the majority of people are still for the most part good and deserve your trust.

Additional Notes:

Bernard Madoff: the man with the most comical name for a fraudster embezzling money. Really though, once you get to swiping fifty billion dollars before anyone notices, that’s undeniably talented.

You’ll notice I painfully avoided the phrase “Credit Crunch”. I can’t stand it. What’s even worse is that at some point I heard a stupid joke referring to a cereal called “Credit Crunch” and now all I can see when someone says something about financial complications, is a bowel of cornflakes.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment